Autor: forneas

-

The Economics of Credit Card Interest Rates: Navigating Regulation and Market Dynamics

Credit cards have become ubiquitous in modern economies around the world, serving as a convenient payment method and a source of revolving credit for consumers. The interest rates charged on credit card balances are a critical factor in the credit card economy, affecting the financial well-being of consumers and the profitability of lenders. Understanding the…

-

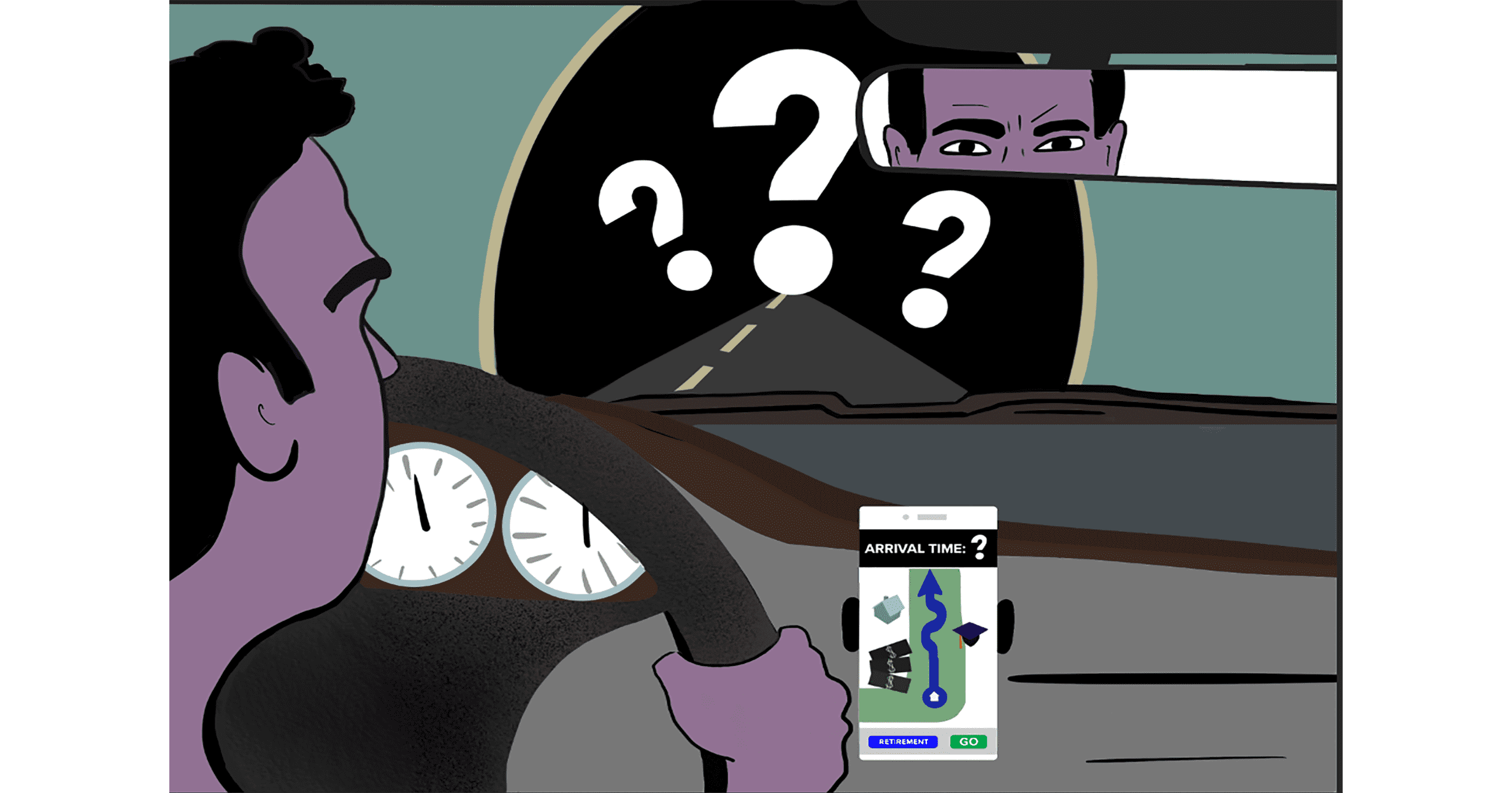

From Owing to Owning: A Practical Guide to Debt Management and Investment

The path from overwhelming debt to savvy investment is not just a journey of numbers and economics; it’s a transformation in mindset and lifestyle. For many, the burden of debt feels like a heavy chain that restricts the freedom to make meaningful financial decisions, such as saving for retirement or investing in opportunities that can…

-

The Pros and Cons of Using a Consortium to Finance Your Home Construction

Financing a home construction project can be a challenging endeavor, especially in a world with increasing material costs and regulatory complexity. Traditional lending options, like bank loans, have long been the go-to solution. However, innovative financing models, such as consortium financing, are gaining traction. This article will explore what consortium financing is, the advantages and…

-

Protecting Your Investments: How to Invest Safely During Economic Uncertainty

Investing can often feel like navigating through a dense fog, where the convoluted paths of economic cycles and forecasts challenge our pursuit of financial stability and growth. Economic uncertainty can come in various forms – from political unrest, changes in monetary policies, to global pandemics. These events can lead to market volatility, which in turn…

-

From Budgeting to Investing: Steps to Acquire a Financial Mindset

Achieving financial security is akin to embarking on a journey – a journey that requires not only the right tools, but also the right mindset. Understanding your finances isn’t just about being able to balance a checkbook or making sure your outgoings are less than your income; it’s about developing a mindset that embraces budgeting,…

-

Real Estate Investment Trusts (REITs): An Investor’s Guide

Investing in real estate has long been viewed as a staple for wealth generation and preservation, offering a combination of income, capital appreciation, and a hedge against inflation. However, direct ownership of property comes with its own set of challenges and barriers to entry, such as the need for significant capital and expertise in property…

-

Under 20 and Overwhelmed by Debt? Here’s What to Do

In a society where debt has become a common part of financial life, managing it effectively is a vital skill—especially for young adults. The excitement of turning 18 and gaining access to credit cards, personal loans, and auto loans often comes with a lack of experience in handling debt responsibly. As a result, many young…

-

Travel the World in Your Golden Years: A Retiree’s Guide

Retirement marks a newfound freedom, a time to enjoy the fruits of one’s lifelong labors. For many, it is an opportunity to embark on adventures that working life may not have permitted. Traveling during retirement isn’t just a leisure activity; it’s a journey of discovery and learning, a chance to explore new cultures, cuisines, and…

-

Navigating Fuel Savings: The Best Credit Cards to Use at the Pump

In the modern world where mobility is key to both work and leisure, fuel costs represent a substantial portion of monthly expenses for many individuals. As the price at the pump fluctuates due to various global pressures, finding ways to save on fuel becomes more than just a thrifty choice—it’s a necessity for maintaining a…

-

Frugal Pharma: Strategies to Cut Down Your Medication Expenses

In today’s world, managing health and wellness is more important than ever, but it often comes with a significant financial burden. For many, the cost of medication can be a major strain on their budget, impacting not just their physical health but their financial stability as well. Whether it’s a temporary prescription or an ongoing…