Introduction to Emotional Intelligence and Its Components

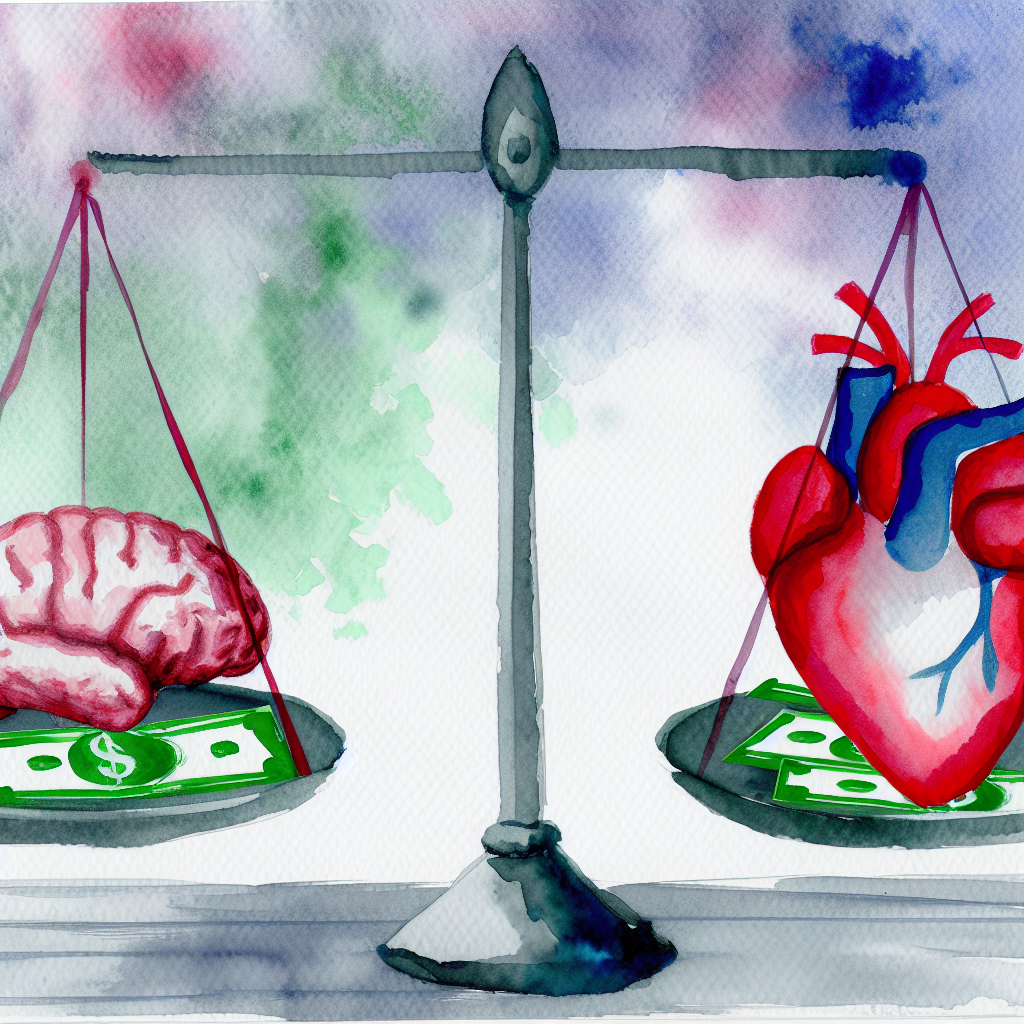

The concept of Emotional Intelligence (EI), or Emotional IQ, has gained significant traction across various sectors, including finance. Unlike traditional cognitive intelligence, which assesses logic and analytical reasoning, emotional intelligence evaluates an individual’s ability to perceive, manage, and regulate emotions. This unique form of intelligence is increasingly recognized as a crucial factor in effective decision-making processes, especially in financial contexts where emotions often swirl beneath the surface of seemingly rational choices.

Emotional intelligence is composed of five core components: self-awareness, self-regulation, motivation, empathy, and social skills. These components work in tandem to help individuals recognize emotional triggers and respond appropriately, rather than reacting impulsively. Self-awareness involves recognizing one’s own emotions and their effects, while self-regulation refers to managing these emotions in a healthy manner. Motivation, empathy, and social skills collectively enhance one’s ability to interact positively with others, foster resilience, and navigate complex emotional landscapes.

In the realm of financial decision-making, these competencies prove to be invaluable. For instance, a financially literate individual might make decisions based solely on numerical data, but an emotionally intelligent person can anticipate and manage stress, fear, or excitement which often accompany financial transactions. This balanced approach leads to more robust and sustainable financial decisions.

The rising interest in emotional intelligence reflects its profound impact beyond interpersonal relationships and psychological well-being. It is now widely regarded as instrumental in achieving financial wellness, management of financial assets, and investment decisions. As we explore the components and implications of emotional intelligence in financial decisions, it becomes clear that mastering this intelligence can lead to improved economic outcomes.

The Importance of Emotional Intelligence in Financial Decisions

Emotional intelligence plays a critical role in financial decision-making due to its ability to shape how individuals perceive and react to financial situations. Conventional wisdom suggests that financial decisions are best made through rational analysis alone, but this discounts the powerful influence of emotions on decision-making processes. Understanding the interplay between emotions and finance can lead to more balanced and effective choices.

Emotional intelligence helps individuals maintain a balanced perspective when facing financial challenges. Self-awareness allows for the identification of personal financial habits and triggers, while self-regulation enables the control of impulses, such as the urge to make impulsive purchases or investments. Emotionally intelligent individuals can use these skills to create practical financial plans and stick to them even when unexpected circumstances arise.

Moreover, motivation and empathy also contribute to making sound financial decisions. Motivation drives individuals to set and achieve financial goals while empathy provides insight into the needs and desires of clients, partners, or peers involved in financial transactions. Social skills, the final component of EI, are crucial for negotiating and maintaining financial relationships, further underscoring the importance of emotional intelligence in financial realms.

How Emotional Intelligence Affects Risk Assessment

Risk assessment is a fundamental aspect of financial decision-making, and emotional intelligence significantly influences how individuals evaluate and respond to risk. Individuals with high emotional intelligence are better equipped to balance risk and reward by effectively managing feelings of fear or overconfidence that can distort risk perception.

In situations of financial uncertainty, emotional intelligence aids in maintaining a cool head. Self-regulation and self-awareness allow individuals to recognize emotional responses that might lead to hasty decisions, such as selling assets during a market panic or holding onto investments during a downturn. By mitigating emotional responses, one can make decisions grounded in facts rather than fear.

Furthermore, emotional intelligence enables better anticipation of market trends and investor behavior. Empathy helps in understanding the sentiment and behavior of other market participants, thus providing a broader perspective of potential risk factors. This holistic view facilitates more precise risk assessment and enhances the ability to foresee potential pitfalls and opportunities.

Ultimately, the ability to manage emotions directly influences one’s aptitude for risk assessment and management. An individual who understands and can harness their emotions is likely to navigate financial decisions more proficiently, leading to more favorable economic outcomes.

Case Studies: Emotional Intelligence in Successful Financial Strategies

Several case studies illustrate how emotional intelligence has been key to successful financial strategies across different sectors. A prominent example includes major investment firms, where traders with a higher degree of emotional intelligence reported more stable investment outcomes compared to their peers with lower emotional EI.

One particular case study focused on a leading consultancy firm that implemented emotional intelligence training for their financial advisors. Post-training results showed a marked improvement in client satisfaction rates and an increase in financial product sales. Advisors who underwent training demonstrated greater empathy and better communication skills, leading to stronger client relations and more tailored financial solutions.

In another example, a multinational corporation faced a challenging merger. The company employed emotionally intelligent leaders who managed the transition smoothly by recognizing and addressing employee concerns, thus maintaining morale and operations stability. Their ability to empathize and communicate effectively allowed the company to navigate potential financial turbulence successfully.

These cases underscore the tangible impact of emotional intelligence in finance, showcasing that those who prioritize and develop these skills are better poised to achieve successful financial outcomes.

Developing Emotional Intelligence for Better Financial Outcomes

Enhancing emotional intelligence is a worthwhile investment for anyone aiming to achieve better financial outcomes. Several strategies can be adopted to develop this form of intelligence, thereby improving financial decision-making capabilities.

Firstly, undertaking self-reflection activities to increase self-awareness is a critical step. Regularly evaluating emotional responses to financial transactions can help individuals identify their emotional triggers. Techniques such as journaling or seeking feedback from peers can provide insights that aid in self-understanding.

Secondly, learning stress management techniques can enhance self-regulation. Techniques such as mindfulness and meditation can empower individuals to control emotional responses, especially during high-pressure financial situations. Additionally, setting clear goals and maintaining a routine can foster discipline in financial planning and execution.

Finally, developing empathy and social skills through active listening and effective communication can enhance interactions with stakeholders involved in financial dealings. Engaging in role-playing scenarios or communication workshops can simulate various financial contexts, and improve one’s ability to handle real-world situations effectively.

By investing time and resources into developing emotional intelligence, individuals and organizations can cultivate a competency that profoundly impacts financial success.

The Interplay Between Emotional Bias and Financial Decisions

Emotional biases, such as overconfidence, fear, and loss aversion, frequently impact financial decisions. Emotional intelligence can help mitigate these biases, leading to more rational and beneficial financial outcomes.

Overconfidence, a common bias, can lead to excessive risk-taking without adequate analysis. Individuals with high emotional intelligence recognize this tendency and regulate their confidence levels, ensuring a balanced approach to risk and decision-making. They are also more open to feedback and alternative perspectives, further refining their choices.

Fear and loss aversion often result in overly conservative decisions that might sacrifice profitable opportunities for perceived safety. Emotional intelligence equips individuals with the tools to confront these biases, ensuring that decisions are based on objective analysis rather than undue caution.

Moreover, the interplay between emotional intelligence and emotional biases is evident in the ability to manage emotions like anxiety or excitement that can cloud judgment. Emotional intelligence allows one to maintain focus on long-term financial goals, regardless of short-term emotional influences.

By understanding and addressing emotional biases through emotional intelligence, financial decision-makers can improve their analytic capabilities, leading to more effective financial strategies.

Practical Techniques to Enhance Emotional Intelligence

Developing emotional intelligence involves continuous practice and application of specific techniques aimed at improving the core components of EI. Here are some practical techniques that can help enhance emotional intelligence:

-

Mindfulness Meditation: Regular practice of mindfulness meditation can boost self-awareness by helping individuals become more attuned to their emotions and thoughts.

-

Active Listening Exercises: Engaging in exercises that involve paraphrasing and summarizing what others say can enhance empathic skills and improve social interactions.

-

Emotional Journaling: Daily journaling of emotions and reflecting on how they impact decisions can improve self-awareness and self-regulation.

-

Role-Playing Scenarios: Participating in role-playing activities can improve empathy and social skills by simulating financial negotiation and decision-making situations.

-

Feedback Seeking: Actively asking for feedback from peers and supervisors can provide insights that drive improvement in emotional intelligence skills.

These techniques can be integrated into daily routines, making the enhancement of emotional intelligence a consistent and manageable goal.

The Role of Emotional Intelligence in Investment Decisions

Investment decisions are inherently emotional due to the risks and unknowns involved. Emotional intelligence helps investors navigate these complexities by maintaining a balanced emotional state and focusing on rational analysis.

Self-awareness and self-regulation enable investors to recognize and control emotional reactions to market volatility. For example, in sudden market crashes, emotionally intelligent investors can avoid panic-selling and instead evaluate the situation with a clear mind, potentially taking advantage of undervalued opportunities.

Moreover, emotionally intelligent investors display higher motivation, driving them to diligently research and continuously update their market knowledge. Empathy and social skills further support effective communication and collaboration with financial advisors and peers, facilitating informed investment choices.

The ability to maintain composure and make unbiased decisions ensures that investments align with long-term financial goals, enhancing the probability of achieving desired economic benefits.

How Stress and Emotions Influence Financial Choices

Stress and emotions are powerful drivers of financial decisions, often leading individuals to act contrary to their best interests. High stress levels can impede clear thinking, resulting in impulsive financial choices, whereas emotions such as fear and greed can skew judgment.

Emotional intelligence provides a buffer against the adverse effects of stress on decision-making. By employing stress management techniques like deep breathing, emotional intelligence practitioners can reduce anxiety and maintain clarity during financial transactions.

Additionally, understanding one’s emotions aids in maintaining focus on long-term objectives, despite short-term emotional distractions. For instance, emotionally intelligent individuals recognize when fear is distorting their perception of market risks and can adjust their strategies accordingly.

Ultimately, controlling stress and emotions through enhanced emotional intelligence can lead to more deliberate and effective financial choices.

| Factor | Influence on Financial Choices | Emotional Intelligence Role |

|---|---|---|

| Stress | Impulsive decisions | Provides coping mechanisms for clarity |

| Fear and Greed | Skewed judgment | Recognizes and moderates biases |

| Anxiety | Hasty actions | Employs stress-reduction techniques |

| Emotional Biases | Distorted perceptions | Promotes rational analysis |

Mental Health, Emotional Intelligence, and Financial Wellness

The connection between mental health, emotional intelligence, and financial wellness is increasingly acknowledged. Sound mental health underpins emotional intelligence, while financial wellness contributes to overall life satisfaction.

Emotional intelligence promotes mental health by equipping individuals with strategies to manage stress and foster positive relationships. This emotional resilience translates to improved financial decision-making, as individuals can prioritize long-term goals over short-term emotions.

Moreover, financial wellness reinforces mental health by reducing stress associated with financial insecurity. By applying emotional intelligence in personal finance management, individuals can achieve greater financial stability and, consequently, enhanced mental health.

A holistic approach that integrates emotional intelligence and mental health strategies can optimize financial wellness, enabling individuals to lead more financially and emotionally fulfilling lives.

Conclusion: The Economic Benefits of High Emotional Intelligence

Emotional intelligence is an indispensable asset in financial decision-making, significantly impacting risk assessment, investment choices, and financial strategies. By developing emotional intelligence competencies, individuals and organizations can achieve more favorable economic outcomes.

High emotional intelligence allows individuals to manage emotional stressors and biases, leading to more rational and informed financial decisions. As demonstrated through case studies, emotionally intelligent financial strategies have the potential to yield higher returns and foster stronger client and partner relationships.

In the broader context, enhancing emotional intelligence not only leads to individual financial success but also contributes to economic stability. Emotionally intelligent leaders and investors can navigate market fluctuations more effectively, promoting sustainable economic growth.

In conclusion, the benefits of high emotional intelligence extend beyond immediate financial gains to encompass long-term economic advantages, underscoring its importance in contemporary financial landscapes.

FAQ

1. What is emotional intelligence, and why is it important in finance?

Emotional intelligence is the ability to perceive, understand, and manage one’s emotions. In finance, it helps individuals make balanced decisions by managing emotions that might influence financial choices.

2. How does emotional intelligence affect investment decisions?

Emotional intelligence allows investors to maintain composure and make unbiased decisions, aligning investments with long-term goals despite market volatility and emotional pressures.

3. Can emotional intelligence be developed over time?

Yes, emotional intelligence can be developed through self-reflection, mindfulness practices, and empathy-building exercises, leading to improved financial decision-making.

4. How do emotions impact financial decisions?

Emotions like fear, greed, and stress can distort judgment, leading to impulsive or overly cautious financial choices. Emotional intelligence helps manage these emotions for better outcomes.

5. What role does emotional intelligence play in financial risk assessment?

High emotional intelligence aids in balancing emotional responses during uncertainty, allowing for more accurate risk assessment and decision-making grounded in data rather than emotion.

Recap

- Emotional intelligence encompasses five core components: self-awareness, self-regulation, motivation, empathy, and social skills.

- In financial decision-making, emotional intelligence helps manage emotions that influence risk assessment and investment choices.

- Emotional intelligence can mitigate emotional biases and lead to more rational financial strategies.

- Developing emotional intelligence enhances both mental health and financial wellness, contributing to overall life satisfaction.

References

- Goleman, D. (1995). Emotional Intelligence: Why It Can Matter More Than IQ. Bantam Books.

- Thaler, R. H., & Sunstein, C. R. (2008). Nudge: Improving Decisions About Health, Wealth, and Happiness. Penguin Books.

- Ariely, D. (2008). Predictably Irrational: The Hidden Forces That Shape Our Decisions. HarperCollins.

Deixe um comentário