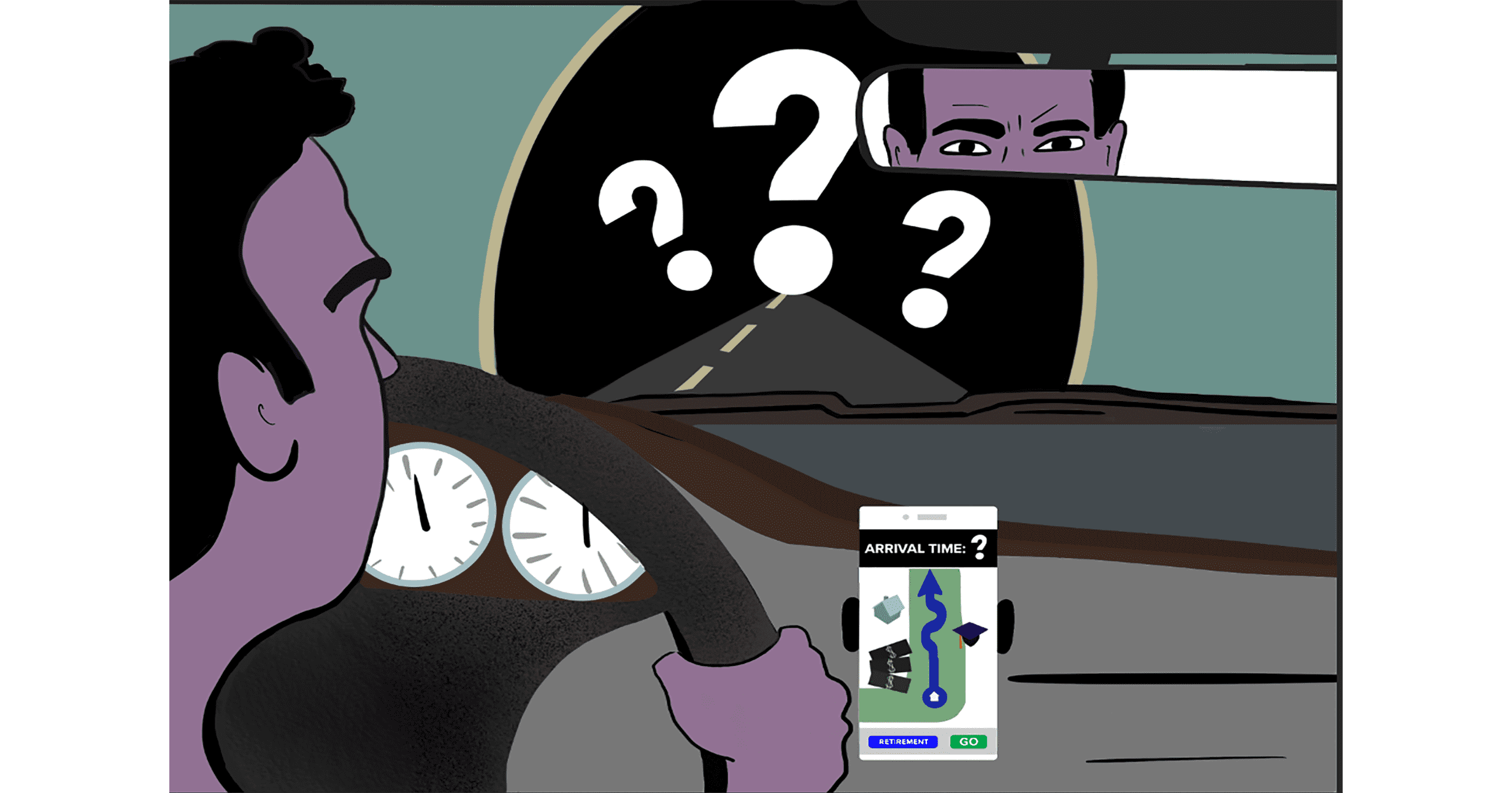

The path from overwhelming debt to savvy investment is not just a journey of numbers and economics; it’s a transformation in mindset and lifestyle. For many, the burden of debt feels like a heavy chain that restricts the freedom to make meaningful financial decisions, such as saving for retirement or investing in opportunities that can generate long-term wealth. However, once we understand the principles of debt management and grasp the basics of investment strategy, that chain can slowly be unlocked, leading us not only to freedom from debt but towards the empowerment of ownership.

Getting to the point of owning your financial future begins with an honest and comprehensive assessment of where you currently stand. It involves taking stock of all debts owed, setting tangible and realistic goals for repayment, and creating a balanced plan that still allows room for growth through investment. This guide will walk you through these critical steps, offering practical advice that can not only help you manage and reduce your debt but also provide a roadmap for taking those first, crucial steps towards investment.

Our journey towards financial literacy and asset building may not always be smooth. There will be bumps and detours along the way. Nonetheless, the true power lies in equipping ourselves with the knowledge and tools that enable us to make informed decisions. By learning from the experiences of others and understanding common pitfalls, we can navigate these challenges with greater ease.

In this article, we offer more than mere tips and tricks; we lay out a comprehensive strategy for economic empowerment. This guide is designed to help you reassess and take control of your financial life, from owing to owning, by focusing on targeted debt management practices and introducing investment strategies that accommodate and empower indebted individuals.

Assessing Your Financial Situation: Debt Inventory

Before you can plan your escape from debt, you need a clear understanding of the mountain you have to climb. This step involves creating a detailed inventory of your current debts. Items in your debt inventory should include:

- The lender’s name

- The amount you owe

- The interest rate

- Minimum monthly payments

- Loan terms and conditions

- Collateral (if any) associated with the debt

Creating a debt inventory gives you a comprehensive picture of your financial obligations and helps you prioritize which debts to tackle first. Usually, debts with higher interest rates should be targeted first, as they cost you more over time.

| Lender | Amount Owed | Interest Rate | Minimum Payment | Due Date |

|---|---|---|---|---|

| Lender A | $5,000 | 20% | $150 | 10th |

| Lender B | $10,000 | 5% | $200 | 15th |

| Lender C | $3,000 | 15% | $90 | 20th |

Not only does the debt inventory help in strategizing repayment plans, it can also be an eye-opening experience. Seeing all debts listed in one place can sometimes be a shock, but it’s a necessary wake-up call that propels you into action.

Practical Steps to Managing and Reducing Debt

Now that you have a clear outline of your debts, the next practical step is to formulate a strategy to manage and pay them off. Here’s how you can go about it:

- Budgeting: Start by budgeting your income and expenses. Identify areas where you can cut back and apply the saved money toward your debts.

- The Snowball Method: Begin with the smallest debt and pay it off aggressively while making minimum payments on the others. Once it’s paid off, move on to the next smallest debt. The satisfaction of eliminating debts one by one can provide a psychological boost.

- The Avalanche Method: Alternatively, tackle the debt with the highest interest rate first. This method can save you money in interest payments in the long run.

| Method | Pros | Cons |

|---|---|---|

| Snowball | Quick wins boost motivation | Potentially more interest paid over time |

| Avalanche | Saves money on interest | May take longer to pay off first debt |

Seeking professional assistance through credit counseling or debt consolidation might also be viable options for some. These agencies can negotiate with lenders on your behalf to lower interest rates or consolidate multiple debts into one manageable loan.

Understanding the Basics of Investment for Debtors

Investing may seem like a distant dream when you’re mired in debt, but it’s crucial for long-term financial health. It’s important to understand that debt repayment and investment are not mutually exclusive. In fact, once you have high-interest debt under control, investing—even in small amounts—can work in tandem with your debt reduction plan.

When starting on your investment journey, here are some basics:

- Risk Tolerance: Determine your risk tolerance. It will influence the kind of investments that are suitable for you.

- Investment Vehicles: Familiarize yourself with various investment vehicles like stocks, bonds, and mutual funds. Each comes with its own set of risks and rewards.

- Diversification: Never put all your eggs in one basket. Diversification can help spread risk.

Starting with low-risk investments that offer steady returns may be a wise approach. Retiring high-interest debt should remain a priority, but if your employer offers a matched retirement plan, it might be worthwhile to contribute enough to get the full match even while you’re paying off debt.

How to Create a Balanced Financial Plan

A balanced financial plan accounts for both debt payments and wealth-building investments. It’s your roadmap to financial security and requires regular updates as your financial situation changes. Here are steps to creating your plan:

- Evaluate: Start with a clear, current view of your finances, just like your debt inventory.

- Set Goals: Know what you’re aiming for, whether it’s being debt-free, owning a home, or retiring by a certain age.

- Action Plan: Set clear steps to achieve your goals, such as paying an extra $100 towards your highest-interest debt or investing in a 401(k).

| Short-Term Goals | Medium-Term Goals | Long-Term Goals |

|---|---|---|

| Emergency fund | Pay off all non-mortgage debt | Retirement fund |

Reviewing this plan annually, or when significant financial changes occur, ensures that it remains aligned with your goals and adjusts to changes in income, debt levels, and personal priorities.

Case Studies on Effective Debt Management and Investment

Learning from others’ experiences is valuable. Let’s observe a few hypothetical case studies which illustrate effective debt management and investment strategies:

- Anna: She used the snowball method to eliminate credit card debt and started investing in low-cost index funds. Within five years, Anna both became debt-free and built a modest investment portfolio.

- John: Facing overwhelming medical bills, John worked out a repayment plan with lower interest rates through a debt counseling service. Simultaneously, he contributed to his 401(k) to maximize employer matching.

- Maria and Carlos: After consolidating their student loans and credit card debt, this couple invested in rental properties that generated cash flow to assist with debt payments and create a new income stream.

Each case highlights the importance of a tailored plan fitting individual circumstances.

The Benefits of Being Financially Literate on Your Investment Journey

Financial literacy is empowering; it’s the foundation for making informed and effective decisions. Here are several benefits:

- Better Debt Management: Understanding interest rates and repayment strategies helps you tackle debt effectively.

- Increased Savings: Knowledge of budgeting and expense tracking can lead to significant savings over time.

- Confident Investing: Being financially literate means you can analyze investment opportunities, diversify your portfolio, and understand the market cycles.

Financial literacy is not innate—it requires a commitment to continual learning. Take advantage of free resources like online courses, seminars, and books to enhance your understanding.

Common Mistakes to Avoid When Managing Debt and Investing

Avoiding common mistakes is crucial for a positive financial journey. Some of the pitfalls include:

- Not Having an Emergency Fund: Without a financial cushion, unexpected expenses can lead you right back into debt.

- Neglecting Insurance: Adequate insurance coverage is important to protect against unforeseeable financial loss.

- Investing in High-Cost Funds: High management fees can eat into your returns. Look for low-cost investment options.

Understanding these mistakes can help you circumvent potential roadblocks on your path to financial freedom.

Tools and Resources for Financial Planning and Literacy

There are myriad tools and resources that can aid in financial planning and literacy:

- Budgeting Apps: Tools like Mint or YNAB can help you track spending and set budget goals.

- Financial Calculators: Use online calculators for debt payoff, retirement planning, or mortgage calculations.

- Educational Platforms: Websites like Investopedia or Khan Academy offer free courses on a range of financial topics.

These resources can be invaluable in improving your financial knowledge and staying on track with your financial plan.

Setting Realistic Goals and Timelines for Your Financial Journey

Realistic goal-setting and timelines are essential to maintain motivation and measure progress. For instance, aiming to pay off $30,000 in debt within a year may be unrealistic for most, but setting a three to five-year timeline might be more achievable. Similarly, expecting to double your investment portfolio in a year is unlikely without taking on untenable risks; a more conservative timeline is typically advisable.

Regularly assess and adjust your goals and timelines to reflect changes in your financial situation. Celebrate small victories to stay motivated but remain adaptable to unforeseen circumstances.

Recap

In this article, we explored the transition from debt to investment:

- Assessing your financial situation through debt inventory

- Managing and reducing debt using budgeting and repayment methods like the snowball or avalanche approach

- Basics of investment, even for those currently paying off debt

- Creating a balanced financial plan that encompasses short-term, medium-term, and long-term goals

- Learning from case studies of effective debt management paired with smart investing

- The vital role of financial literacy in the management and investment journey

- Common mistakes to avoid, such as not having an emergency fund or investing in high-cost funds

- Utilizing tools and resources to aid in financial planning and knowledge acquisition

- Setting realistic financial goals and establishing feasible timelines

Conclusion: Moving Forward with Confidence

As you embark on your journey from debt to investment, remember that it is not a race but a marathon. Taking control of your financial situation by managing and reducing debt, learning about investment, and crafting a balanced financial plan, sets the framework for a sustainable economic future. The end goal is not merely to pay off debt, but to build assets that will allow for long-term financial independence and security.

Financial literacy is the compass that will guide you through the complexities of debt management and into the world of investment. Dedicate time to improving your financial knowledge, it is an investment in itself that pays dividends throughout your life.

Finally, the transition from owing to owning is paved with discipline, patience, and perseverance. Each step forward, no matter how small, is a step towards financial empowerment. Keep your goals in sight, learn from both successes and setbacks, and renew your commitment to your financial well-being consistently.

FAQ

- Is it better to pay off debt before investing?

Paying off high-interest debt should often come before investing, but it can be beneficial to do both concurrently if you have moderate to low-interest debt. - How much should I have in an emergency fund?

It’s generally recommended to have 3-6 months’ worth of living expenses in an emergency fund. - Can I start investing with a small amount of money?

Yes, many platforms allow you to start investing with as little as $5. - What is diversification in investments?

Diversification involves spreading your investments across various asset classes, industries, and geographies to reduce risk. - How often should I review my financial plan?

At least once a year or whenever there is a significant change in your financial situation. - What is the difference between the snowball and avalanche methods of debt repayment?

The snowball method involves paying off debts from smallest to largest, while the avalanche method focuses on paying down debts with the highest interest rates first. - What are some low-risk investment options for beginners?

Savings accounts, certificates of deposit (CDs), and government bonds are considered low-risk investments. - I’m already in debt, how can I possibly afford to invest?

Start by budgeting and addressing high-interest debts first. Once manageable, you can allocate small amounts towards investments, especially if they offer compounds interest over time.

References

- Ramsey, Dave (2019). “The Total Money Makeover: A Proven Plan for Financial Fitness”. Nashville: Ramsey Press.

- Bogle, John C. (2007). “The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns”. Hoboken: John Wiley & Sons, Inc.

- Olen, Helaine and Pollack, Harold (2016). “The Index Card: Why Personal Finance Doesn’t Have to Be Complicated”. New York: Portfolio.

Deixe um comentário